Digital Health Trends 2025 — Insights From 500+ Startup Submissions

Every year, the Future of Health Grant provides a glimpse into the next wave of digital health innovation. This year, that view expanded significantly.

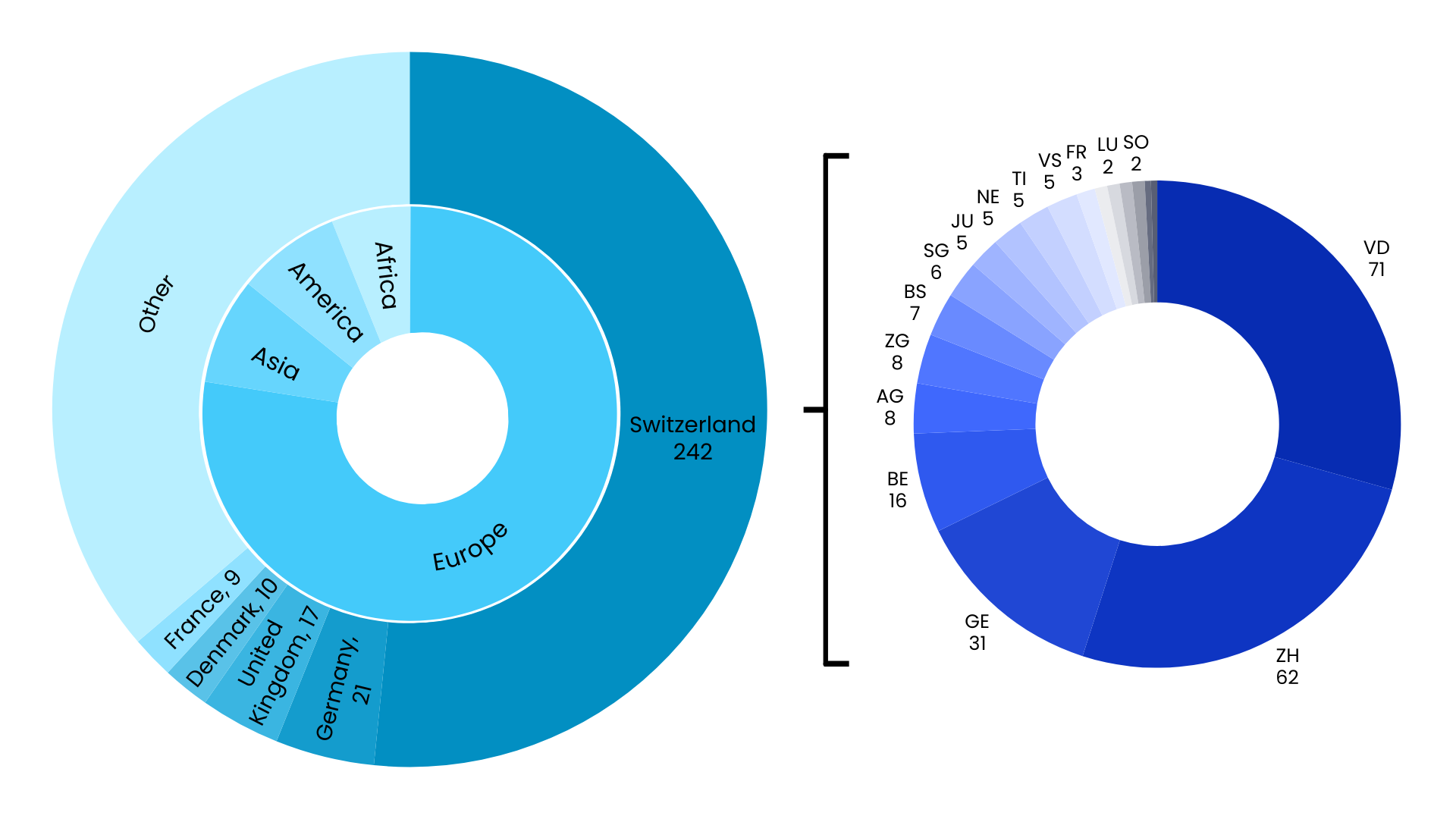

In 2025, we received 523 submissions, representing 469 unique startups after removing duplicates. These applications came from 55 countries, with Swiss startups making up about 52% of the total. Although the Swiss share has been declining in recent years, the absolute number of Swiss applications continues to rise.

Split by country and canton for Swiss applications.

Of the 469 unique startups, 82% applied for the first time in 2025, a clear sign of how rapidly the digital health ecosystem is renewing itself. This momentum also reflects the early-stage focus of our program, which attracts teams at the beginning of their journey.

We looked at this landscape from multiple angles—pathologies, populations, patient journeys, solution types, and technologies—to understand what founders are building and where innovation pressure is strongest. What emerged is a picture of digital health that is both more complex and more coherent than expected.

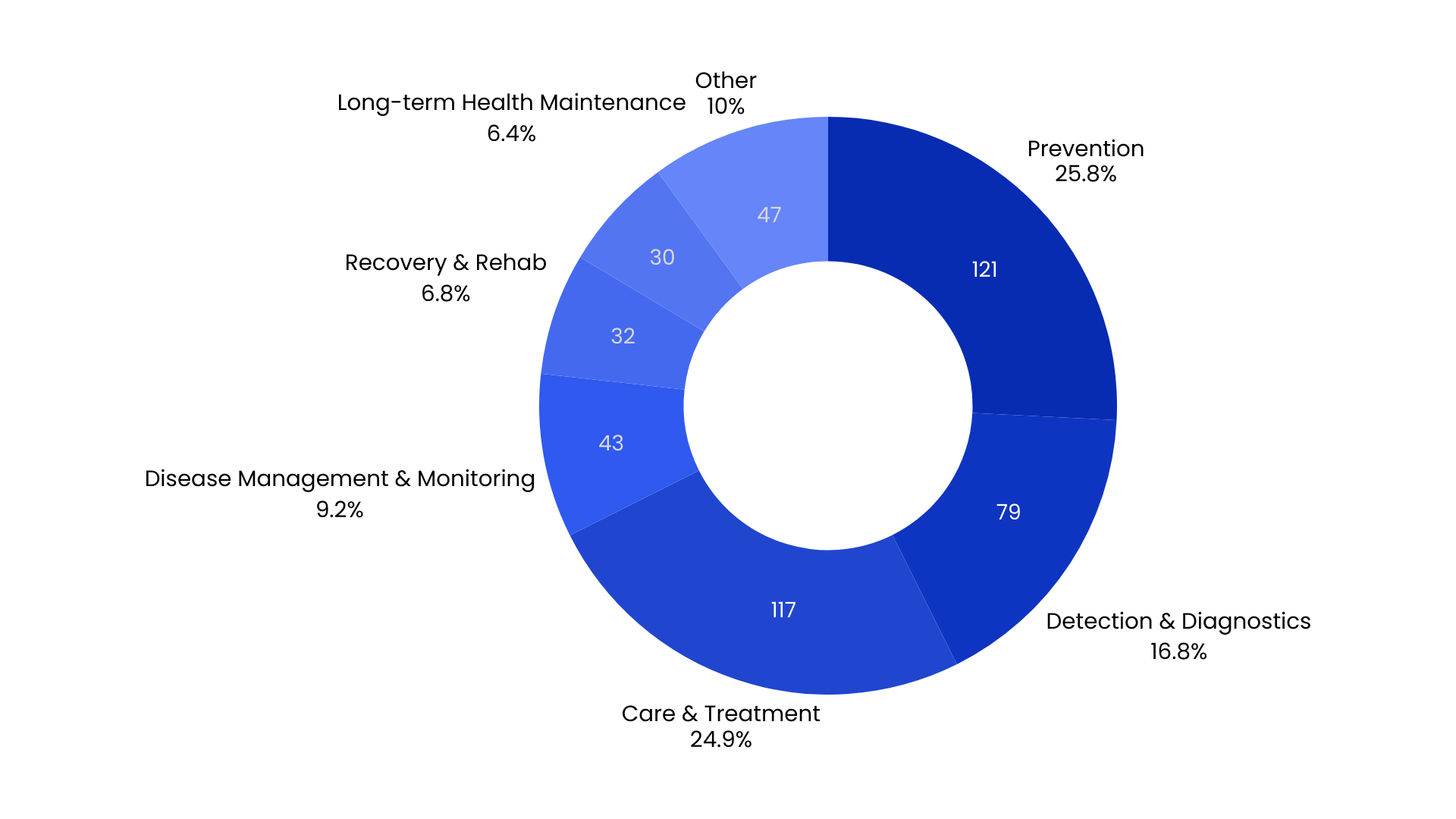

When mapping startups across the patient journey, three stages dominate: prevention with 121 startups, care & treatment with 117 startups, and early detection & diagnostics with 79 startups.

Compared with last year’s analysis, startups are putting a bit less focus on care & treatment, and more on what happens earlier. Prevention is up by 10%, and early detection and diagnostics by 7%.

Prevention is increasingly consumer-driven

This group leans toward everyday health. It’s mostly mobile-first, often uses AI, and focuses more on wellness than on direct medical care. Think mental-wellbeing apps, lifestyle-optimization dashboards, or early risk-scoring tools powered by wearables, sensors, or AI.

Early detection is a technologically advanced frontier

Early detection solutions often mixes AI with scientific methods. Many of these solutions aim to support, or sometimes even replace, traditional diagnostic tests by using computer vision, biomarker analysis, signal processing, or passive monitoring. They often analyze medical images, movement patterns, bio-signals, or even voice and breathing sounds.

No longer siloed categories, these segments form a continuum:

A wellness tool may evolve into a monitoring platform.

A monitoring platform may incorporate diagnostics.

A diagnostic tool may become a regulated therapeutic.

This progression is increasingly common as teams gather evidence, deepen clinical validation, and gradually move toward formal medical pathways.

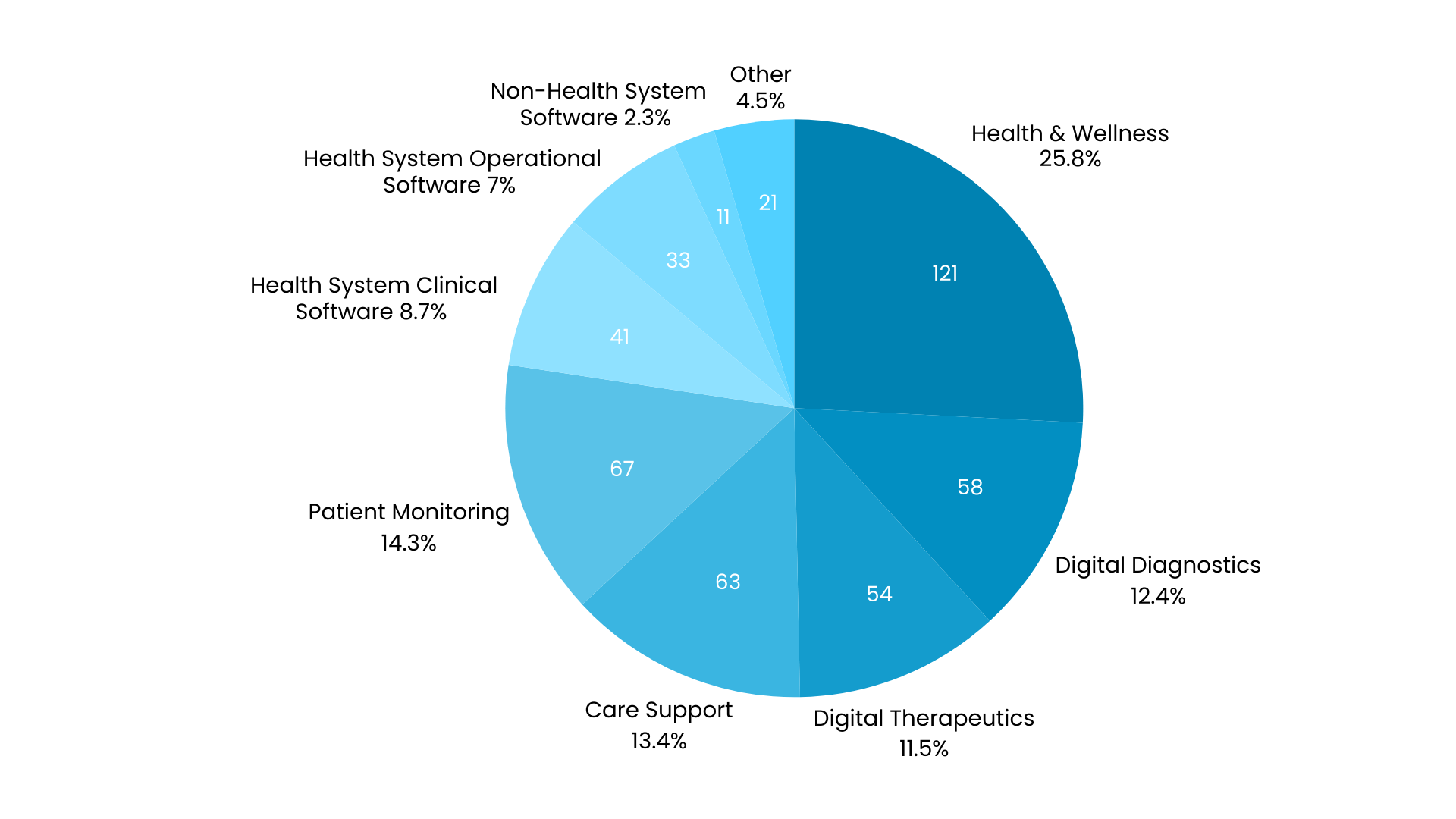

At the same time, we see a wave of hospital-wide digitalization emerging in the health-system categories, with 74 startups building clinical and operational software. As we’ll discuss next, these tools aren’t focused on any single disease. Instead, they aim to make systems talk to each other, streamline workflows, and boost clinical efficiency across the entire healthcare network.

Breakdown by solution type. “Non-Health System” refers to solutions targeting stakeholders other than patients and healthcare providers, such as pharma, OEM, insurers, or employers. Check the Digital Therapeutics Alliance document for more details on this categorization.

These solutions run behind the scenes, but they are increasingly shaping the care experience. They connect with electronic health records, coordinate data exchanges, and help clinicians deliver care more efficiently, regardless of specialty.

This pattern shows a clear shift in ambition. Startups are moving away from narrow, niche tools, toward modernizing the core machinery of healthcare. With clinician shortages, tighter reimbursement rules, and rising administrative complexity, this systems-level focus is both practical and long overdue.

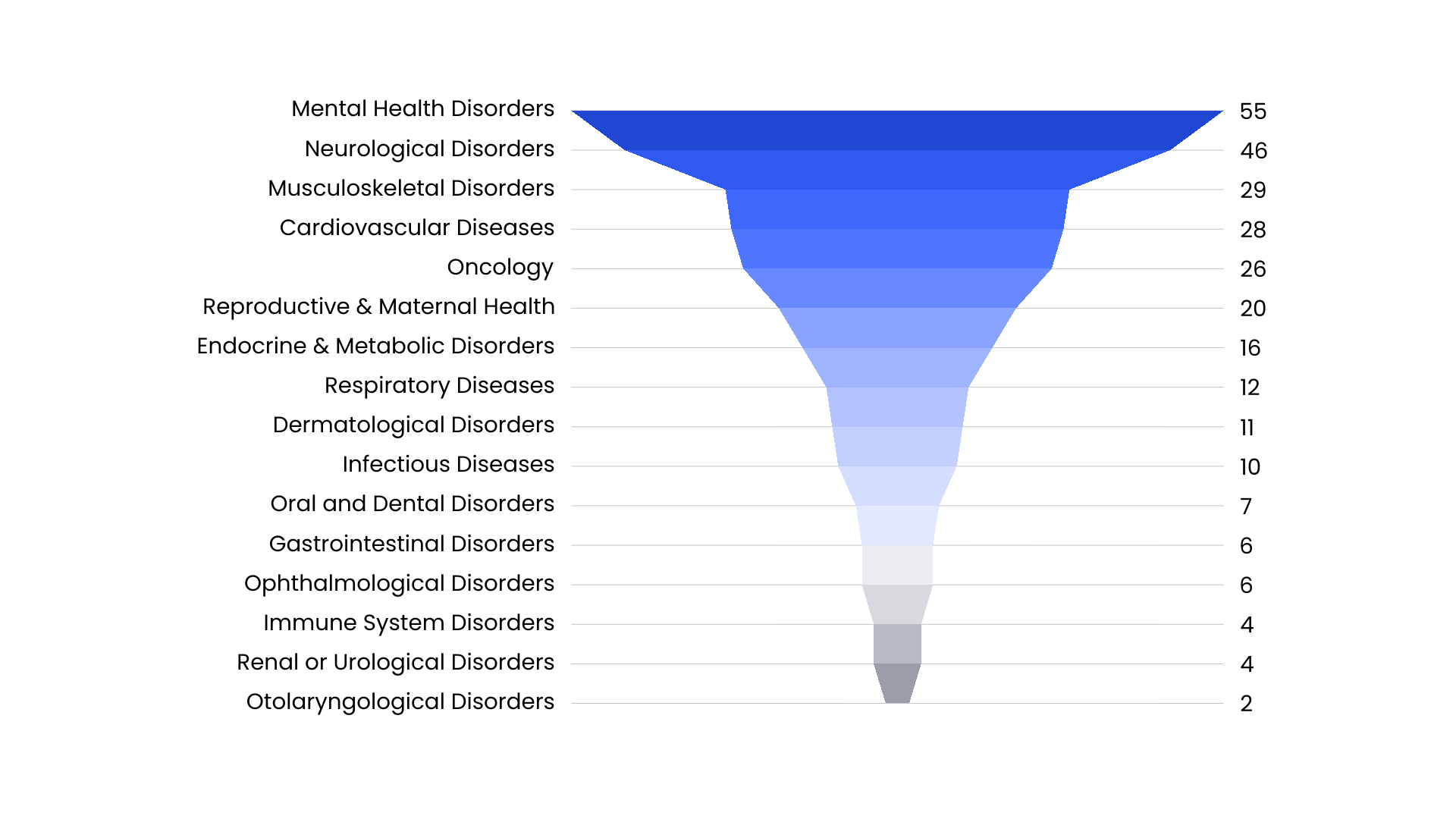

Mental health: preventive, personalized, and mobile-first

Most mental-health solutions focus on prevention and wellness. They aim to provide early support by helping users reduce stress, improve sleep, manage anxiety, prevent burnout, and follow self-guided programs. These tools are typically mobile-first and often integrate features such as voice analysis, behavioral data, or personalized coaching algorithms.

Neurology: clinical, sensor-driven, and rehabilitation-focused

Neurology solutions tend to be more clinical. They focus on three main areas: diagnostics, rehabilitation, and long-term disease management. Wearable devices play a major role, supporting gait analysis, tremor tracking, post-stroke recovery, and cognitive assessments through sensors and guided exercises.

Taken together, these patterns suggest that entrepreneurs see brain-related disorders as one of the areas where digital health can make the biggest impact. This view is reinforced by the fact that such solutions dominate reimbursement claims in countries with dedicated digital-health pathways (for example, Germany’s DiGA framework).

Most startups address the general population, but two groups stand out for receiving much more focused attention: seniors (45 startups) and women (35 startups). And the types of innovations designed for each group differ quite clearly.

Geriatric Health

Solutions for seniors frequently intersect with neurodegenerative conditions, frailty, mobility challenges, and safety concerns. Remote monitoring, fall detection, autonomy-preserving interfaces, and tools for home or nursing home environments are especially common. Many are designed explicitly for long-term care settings rather than hospitals alone. Workforce shortages in elder care appear to be a key driver behind this innovation push.

Women’s Health

Women’s health is no longer limited to fertility. Startups now address a much broader set of needs—from metabolic health and hormonal transitions to oncology and maternal care. One clear trend is the rise of menopause-focused solutions: about one-third of women’s-health submissions concentrate on perimenopause or menopause, using telehealth models, personalized coaching, or new hormone-tracking tools.

This increased attention reflects a long-overdue shift. Women in midlife and older adults represent two of the world’s largest and most underserved patient groups. Startups are finally beginning to design specifically for them, opening up markets that have long been overlooked.

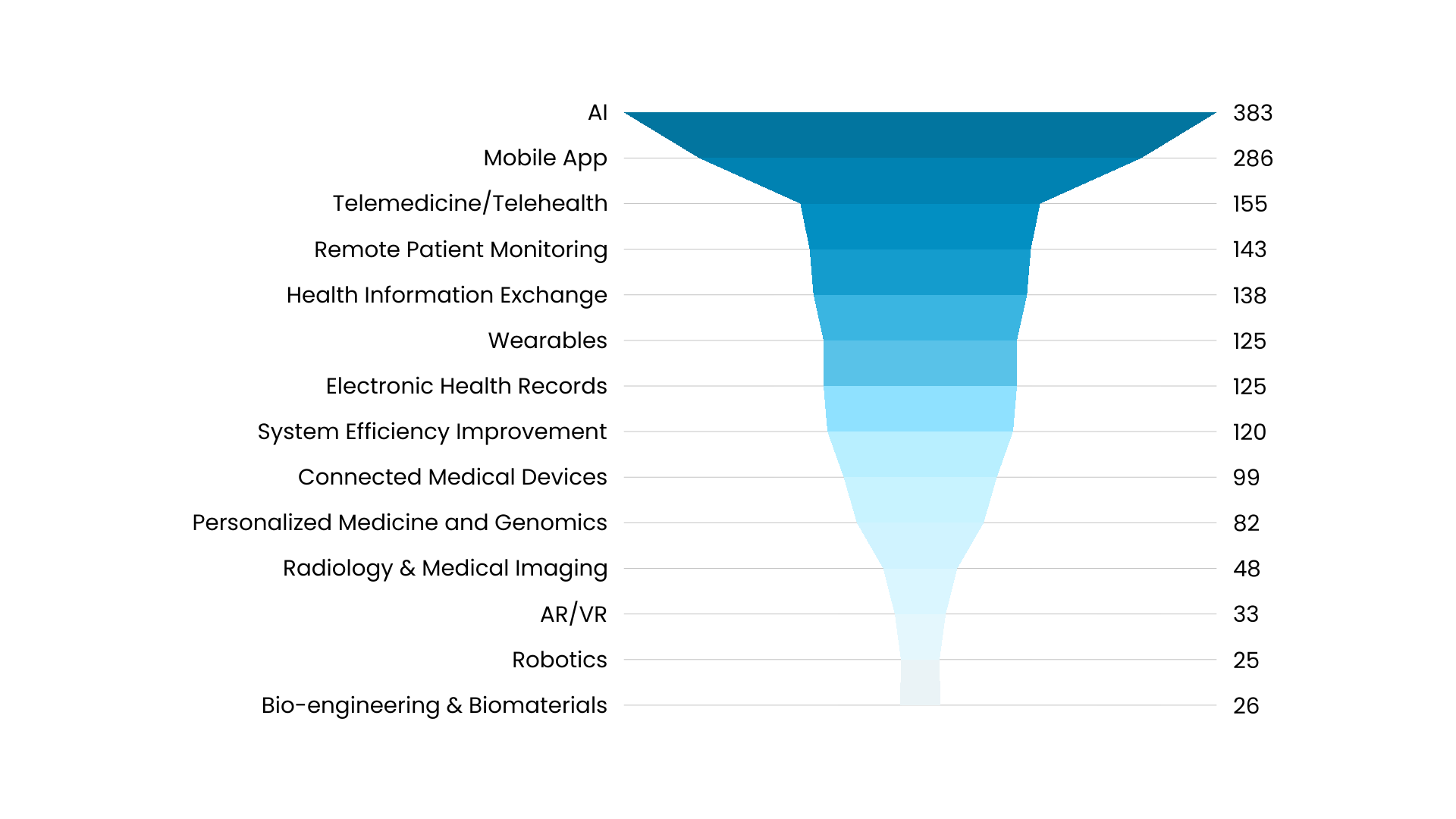

AI appears in 82% of submissions, but the real story is how startups use it as one part of a much broader technology ecosystem.

AI tends to show up in three main ways:

- Clinical AI for decision support, diagnostics, and triage

- Behavioral or engagement AI for coaching, personalization, and nudging

- System-automation AI for workflow automation, summarization, and efficiency

Still, AI is just one part of a multi-layer stack. Three other technology ecosystems strongly shape the portfolio:

Mobile-first care delivery

Mobile-first care puts the smartphone at the center of health interactions. 286 startups use a mobile app as their main interface, supporting secure messaging, symptom tracking, structured assessments, or AI-powered alerts. Within this group, 118 also combine mobile apps with telemedicine, offering video or voice consultations, automated follow-up plans, or hybrid care models that blend remote and in-person care.

Sensor-driven, device-enabled care and monitoring

Monitoring is shifting from episodic to continuous. 125 startups use wearables, and 99 rely on connected medical devices. If we look more broadly at continuous monitoring, 143 startups provide some form of ambient or passive tracking—through movement sensors, physiological measures, or device-based biometrics.

Data infrastructure quietly expands

Data-layer technologies are also gaining ground. 190 startups connect directly to electronic health records (EHR) or health-information-exchange systems, making their solutions easier to embed into clinical workflows from day one.

This year’s analysis reveals a sector in the midst of deep transformation. Digital health is evolving in four clear directions:

- From disease-specific apps to infrastructure that supports the entire health system.

- From isolated care episodes to continuous, hybrid models combining in-person and remote services.

- From reacting to illness to preventing it and detecting issues earlier.

- From generic pathways to personalized, precision-guided care journeys.

Taken together, these shifts show that digital health is no longer a collection of standalone tools. It is becoming a connected ecosystem — where data, AI, sensors, workflows, and human care work together.

And if the 469 startups we examined are any indication, this ecosystem will only grow more predictive, more personalized, more continuous, and more integrated in the years ahead.

Curious to see how your startup fits into these trends? Discover how the Future of Health Grant supports early-stage digital-health founders — and submit your application today.